We’re told that gambling is bad and that taking a certain amount of risk is a necessary part of being human. What is the difference between the two?

| Feature | Gambling | Calculated Risk-Taking |

| Mode of Thought | System 1 | System 2 |

| Expected Value / Utility | Negative | Positive |

| Hope | Wishful Thinking | Realist |

| Locus of Control | External | Internal |

| Motivation | Sensation seeking | Outcome & Process |

| Evaluation Criterion | Outcome-based | Process |

| Worst-Case Scenario | Ruin | Contingency plans |

| Volatility Perspective | Fine | Fee |

| Examples | Roulette, sports betting, lottery, … | Investing (diversified), starting a business, getting married, ... |

A Gamble is a shot in the dark. A Calculated Risk is a shot taken in the light.

Gasvim Lampp – Quora

Gambling is a system 1 activity. It’s what you do when you listen to the voice inside your head telling you: “Screw it. I’m feeling lucky.” It is often associated with a negative expected value (EV). In other words, it wouldn’t be advantageous for you to take the same bet in the long run. It’s the wishful thinking super-fueled by our sensation-seeking tendencies that take over and make us gamble.

Gamblers evaluate the quality of their decisions based on outcomes. Calculated risk-takers evaluate the quality of their decisions based on the quality of their thinking. Was their expected value positive? Did they put the odds in their favour by betting on something they could control to some degree? Did they plan for and accept the potential downfalls? Would the worst-case scenario of the bet ruin them and put others in harm? These contingency plans allow the risk-taker to stay equanimous in the face of undesired events. Gamblers instead prefer to take a shot in the dark and leave everything in the hands of the goddess of randomness.

Risk-takers are aware of the risk of non-action and missed opportunities. Non-invested money is almost certain to dwindle in purchasing power due to inflation. Health is certain to deteriorate in the face of disease unless willing to take some treatment risk. They take risks when they need to while simultaneously minimizing the variance and impact of the likely bad bounces they are sure to encounter. They view market downturns as a cost to reap the fruits of higher expected returns. On the other hand, gamblers take market downturns personally. They feel cursed by the gods. They see negative returns as a punishment, as a fine, instead of perceiving them as the price of admission.

Even if the outcome of a decision is positive, it doesn’t necessarily qualify as a success. If the process was shallow, you were lucky. If the decision process was deep, you can count it as an improvement: you’ve discovered a better practice. If the outcome is negative, it’s a failure only if the decision process was shallow. If the result was negative but you evaluated the decision thoroughly, you’ve run a smart experiment.

Adam Grant – Think Again

Examples

Virtually all activities that include some degree of randomness could be a gamble or a calculated risk, depending on the person’s approach. I tried to place the following examples in order from the most obvious to the more nuanced.

Gambling

- Playing roulette at the casino would be an example of pure gambling. The expected value (EV) is negative. The only reason a “rational” person would place a bet would be for entertainment or if the casino had a promotion that made the EV positive. By the way, you have a pretty good chance of walking out of the casino with more money than you came with if you play strategically and cash out in time. That said, not many have the personal discipline to walk out when they’re up. Furthermore, according to the law of large numbers, it is practically impossible to make money by playing roulette in the long term.

- Buying lottery tickets is another obvious form of gambling. You’ve heard phrases such as: “You never know.” or “Someone has to win. Why not me?” These lines of inquiry all reek of wishful thinking. There’s something to be said for local fundraisers, where your odds are often better and your losses also contribute to a good cause. Again, there is nothing inherently wrong or evil with buying lottery tickets. We just need to be honest with ourselves that we are almost certainly not going to win a jackpot even if we play weekly until we die. It’s no coincidence that gambling is one of the major sources of revenue for the government.

- Sports betting is a less obvious example of gambling. In fact, some very calculated risk-takers do a decent job of exploiting the rare bargains of the betting apps. The issue is most people don’t have the discipline and resources to do the necessary work to tip the sports gambling industry into a risk-taking category. Most of my friends who place bets on sports do so for entertainment based on their impaired hunches, without even calculating the probability implied by the money line. The house always estimates the probability of an event using advanced statistical modelling and rich data sources. To ensure that they’ll make money more often than not, the house also gives itself an edge by adjusting the payouts accordingly.

Calculated Risk-Taking

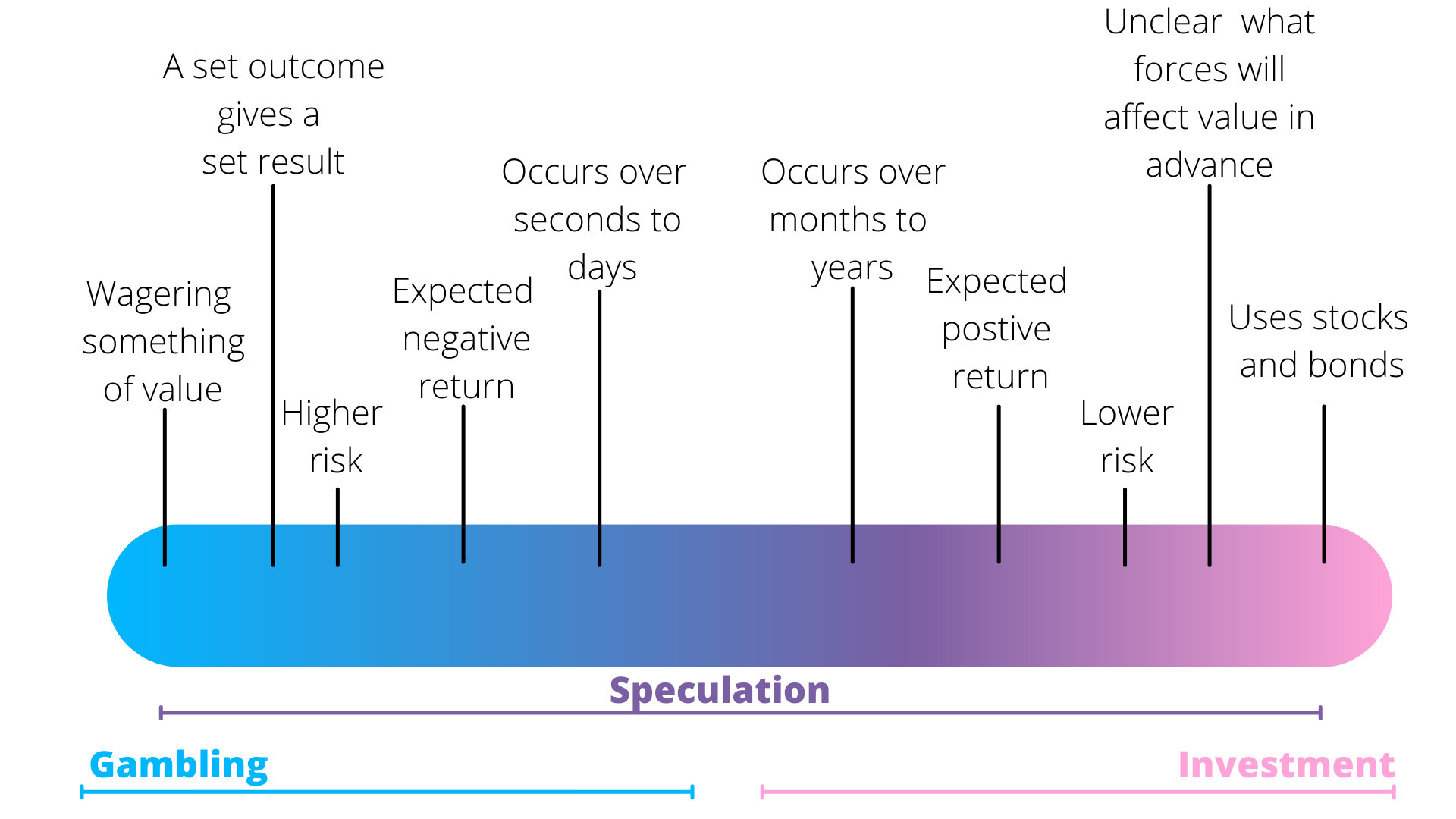

- Investing is a form of calculated risk-taking. A globally diversified portfolio has shown to be extremely likely to generate a return on investment over a lifetime. It’s important to know the difference between investing and gambling when it comes to personal finances. Figure 1 can help us differentiate between the two. Placing all your savings into the latest cryptocurrency (gambling) is different from automatically investing 10% of your paychecks into a low-cost diversified ETF.

- Starting a business can be an example of a calculated risk. The entrepreneur must face the facts. The vast majority of businesses “fail” within the first few years. To an entrepreneur, however, failure is not as simple as losing money. They often see their startups as experiments and opportunities to learn. When done right, they can also mitigate the risk of bankruptcy by establishing contingency plans in advance. For myself, starting a YouTube channel was a risky endeavour I decided to take on. I’m fully aware that nearly all channels are not financially successful. The many hours that go into writing articles such as this one or creating videos could be spent on other more lucrative projects. That said, I believe that my probability of earning a reasonable salary from this only gig is high if I keep growing an audience over a lifetime. Worst case scenario, I never make much money from the internet. I still would learn new skills and refine my thinking, which are worthwhile dividends. An important caveat to this way of thinking is that the cost of starting an internet business is close to zero. We have all seen poor entrepreneurs on shows such as Shark Tank or Dragon’s Den that are possessed by the sunk-cost fallacy. You don’t always have to burn the boats to run a successful business.

- Poker is arguably the most controversial yet purest of calculated risk-taking. In fact, poker players are professional risk-takers. I think bankroll management theory is the best example of how poker players fully accept variance as a reality and act accordingly. They measure their success as the number of big blinds won per 100 hands played. Even if they’re confident that their BB/100 is positive, the discipline players only stake between 1 to 5% of their total bankroll at a time. They do so because they know that is likely to go bust many times in a row, even as a positive EV player. It’s worth emphasizing once more: Avoid putting all your eggs in the same basket if you have a chance of losing. No matter how small that chance is.

And poker does have an element of chance, to be sure—but what doesn’t? Are poker professionals “gamblers” any more than the man signing away his life on a professional football contract, who may or may not be injured the next week, or find himself summarily dropped from the team in a year because he failed to live up to his promise? We judge the poker player for gambling; we respect the stockbroker for doing the same thing with far less information. In some ways, poker players gamble less than most. After all, even if they lose an arm, they can still play.

Maria Konnikova – The Biggest Bluff

Conclusion

Nothing is inherently good or bad, good or evil. Pure gambling could be reasonable for you as a form of entertainment or a fundraiser. That said, make sure to set a hard limit on the resources (time, energy, money) that you dedicate to gambling.

Ideally, we could all coast through life and get what we want without having to take risks. Life simply doesn’t work that way. There are micro risks at any moment and several inevitable macro risks we’ll have to take over the course of our life. Given this cruel reality, our only hope is to better expert risk-takers who voluntarily confront and make peace with the unpredictability of nature.

Resources

- Lara Buchak – Mindscape Podcast

- Thinking, Fast and Slow – Daniel Kahneman

- The Psychology of Money – Morgan Housel

- Think Again – Adam Grant

- Thinking in Bets – Annie Duke

- The Biggest Bluff – Maria Konnikova