I recently listened to episode 147 of the Rational Reminder podcast with Paul Merriman. He said that the most fundamental investing question you can ask yourself is:

What is your primary long-term investment objective?

To beat the market.

To get the highest return within your risk tolerance.

To find the lowest risk way to achieve the return you need.

Paul Merriman

The three objectives above are ranked by the amount of risk needed to achieve the desired goal. He would ask his clients who claimed that they wanted to beat the market whether they were ready to lose 40% if the market was down by 50%. Most people said no right away. Instead, they wanted to beat the market regularly while never losing beyond a certain percentage. This automatically pushes them into the second category. They want the highest return within their risk tolerance.

In this category, the challenge is to figure out how much you are willing to lose (i.e. your risk tolerance). Most people can’t know their risk tolerance until they experience a wide variety of losses. Personally, I do not want to think about money more than I need to. I would start to sweat after losing anything close to 20%. Paul goes on to tell his clients that in order to get the highest return within their risk tolerance, he will need to do his best to make them lose a percentage close to their worst-case scenario. If he doesn’t take enough risk, then they won’t get the highest return possible within their “tolerance”. This is because risk is generally correlated with expected returns (not always). Most people don’t want to hover near their reported lower bound of risk tolerance. This puts them in the third category.

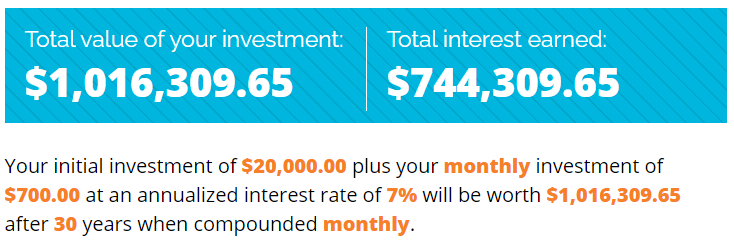

Most folks simply want to find the lowest-risk way to achieve the return they need. In fact, most people don’t want to take any risks, but they feel like they need to. I am turning 25 this summer. I would like to save one million dollars by the time I am 55 (30 years to grow). This number is based on the Four Percent Rule which would ensure a decent quality of life during retirement. This is especially true if I have a pension plan from work in addition to the old-age pension and the CPP. Furthermore, I plan to work past 55 assuming good health.

I would need a monthly investment of $700 at an annualized interest rate of 7%. This calculation is based on a $20000 initial deposit. Feel free to run the numbers for yourself. As of this writing, investing $500 per month would max out your TFSA yearly $6000 contribution room. That said, you can be confident to build a comparable amount by retirement (probably higher) if you max out your TFSA and RRSP for over 25 years.

It is exciting to try to beat the market. It is boring to try to match or even underperform the market. The realization that I do not need to take on as much risk to achieve my financial goals is liberating. It frees me from following the latest trends of the hot stocks and cryptocurrencies. I can put my head in the sand. Invest automatically each month and sleep soundly.

What is your primary long-term investment objective?

Paul Merriman