We made the mistake of visiting model homes in Embrun and Russell. Visiting castles makes you want one. Worse, it fools you into believing that your life is lacking until you have your own little castle.

The models that interested us would be around 800K with everything included. That’s a ton of cashola. A 20% down on 800K is 160K. We could theoretically come up with the money by the time the house is built, and we take possession in 14 months. We were pre-approved by the banks to go through with it. So why didn’t we pull the trigger?

Financial Factors

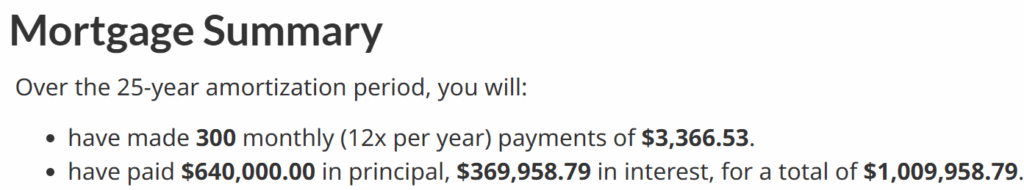

Here’s the monthly mortgage payment with a 25-year mortgage at 4% interest rate:

Here’s the monthly mortgage payment with a 30-year mortgage at 4% interest rate:

Property taxes would be roughly 800$ per month. Utilities would likely come to roughly 500$ per month. Add 200$ monthly for home maintenance costs for small renovations and buying things like a lawn mower, etc. The total housing expenses on the 30-year mortgage would come up to roughly 4500$ per month or 54000$ per year.

We both make roughly 80K per year. This would be doable, but we would be in a vulnerable financial position.

People say that it might be tight at first, but we’d be saving for the future and building equity. That’s true, but we are saving aggressively at the moment while renting. I think this argument applies to people who don’t have the financial literacy or discipline to autosave a portion of their paychecks.

Some folks think that renting is setting your money on fire. Let’s see how much we’d pay in interest and property taxes with our mortgage to see how it compares to our current rent of 2700$ per month. As seen in the picture above, we’d pay 455K$ in interest over 30 years. This results in an average of 1265$ per month paid in interest. Add property taxes and home maintenance in there, and you’re looking at 2300$ in monthly unrecoverable costs.

Ben Felix suggests the 5% rule for deciding whether to buy or rent. Multiplying 800K by 5% and dividing by 12 gives us $3333. Hence, it makes financial sense in our situation to rent, given that we manage to save and invest the difference.

We have assumed a 4% interest rate for the calculations above. But what would happen if the rates skyrocket to 8% or 13.17%? What then? The psychological toll of being financially stretched at the mercy of the gods cannot be ignored.

Psychological Factors

To be frank, money is not the main reason why we chose not to buy a house. It’s the psychological reasons that trouble me the most. I believe money should be used to fund a good life. If the good life is expensive, then so be it. But what if buying a house is not part of our rich life?

Your rent is the maximum you’ll pay. Your mortgage is the minimum you’ll pay.

Ramit Sethi

I’m not convinced that buying a house will make us happier. Research seems to support this conclusion. I’ve been tracking my mood for nearly a decade, and nothing seems to have an impact on my happiness. It’s hard to get happier than my relatively high baseline.

There’s a significant possibility it’ll make my life worse.

- I’ll have to commute to work (30 minutes one-way).

- I’ll be financially stretched.

- I’ll have less career freedom as I’ll need a steady income to cover the mortgage payments.

- What if there’s a crack in the foundation?

- My house chores will quadruple.

People would be happier if they reduced their commuting time, even if it meant living in smaller houses.

Jonathan Haidt

The commuting point is the biggest one for me. We both currently walk or bike to work. It’s a great way to get some exercise in and disconnect from work. It’s also better for the environment and the wallet.

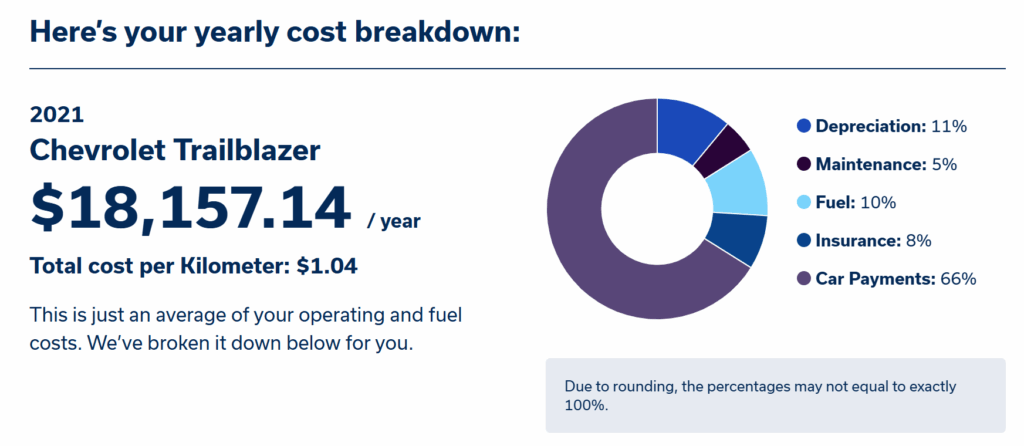

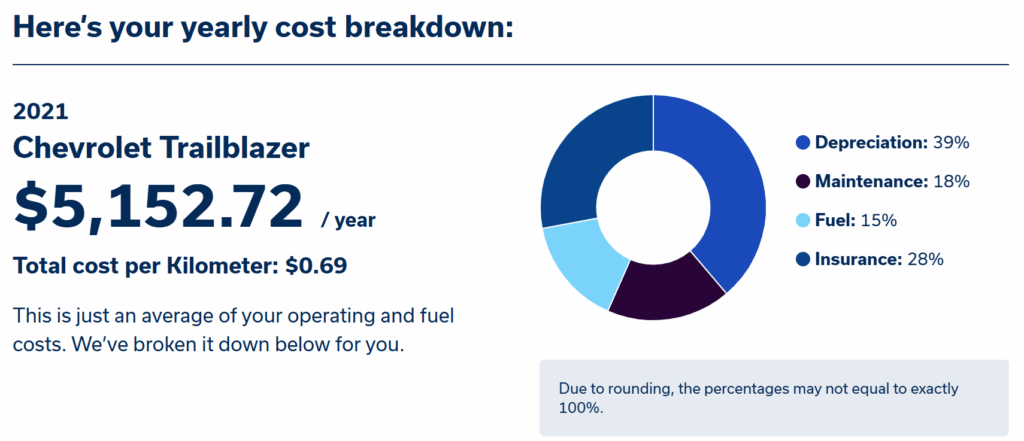

I like this article on the true cost of commuting. Our commute would be approximately 40km one-way for 80km per day times ~220 days per year, resulting in 11000 extra kilometres we’d drive per year. I built this Desmos Calculator to see how much extra we should be willing to pay for an equivalent house 1 km closer. It turns out we should be willing to pay roughly 10K more on a house per km less of commuting. This is with the assumption that our time is worth 10$ per hour. Of course, you can bump up this number, but biking or walking to work takes time as well.

Taking the math above seriously means that we should be willing to pay 400K more for an equivalent house in a neighbourhood that we can bike or walk to work. This makes sense as similar houses in Ottawa go for 1.2 to 1.5 million.

So What’s Next?

We keep maxing out our FHSA until we hit the 40K. We keep maxing out our TFSA and try to contribute into our RRSPs. We keep saving aggressively and benefit from Wealthsimple Premium. We wait for the GST rebate to take place. We stay in our comfortable and nice rental apartment. It’s a three-bedroom, so we can start a family here. The longer we stay, the cheaper our rent will be relative to the market.

We wait. We act in position instead of out of position. We don’t compromise. We don’t give in to societal expectations. We know our values. We continue to look around for an opportunity. We gain information about our careers and family. We rejoice in living within our means.

Work diligently. Diligently. Work patiently and persistently. Patiently and persistently. And you’re bound to be successful. Bound to be successful.

S.N. Goenka