The video below inspired me to step up my credit card game. I go down a personal finance rabbit hole every few years. This year’s rabbit hole was filled with our plan to buy a house and credit card optimization.

The specific details of the cards in this article may be obsolete in ten years. However, the thinking framework will continue to be useful moving forward.

I aim to determine which credit card I should use for every area of my spending. To get there, I need to know what I spend my money on and which cards offer the best rewards for those categories.

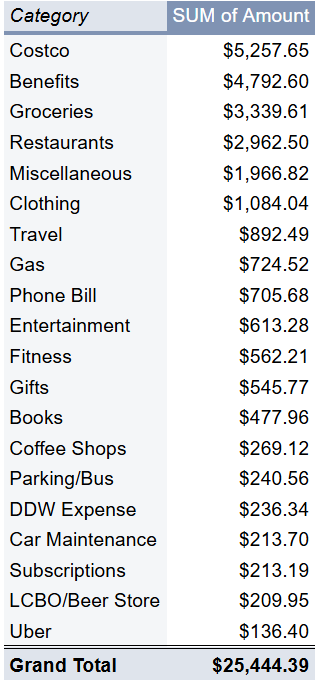

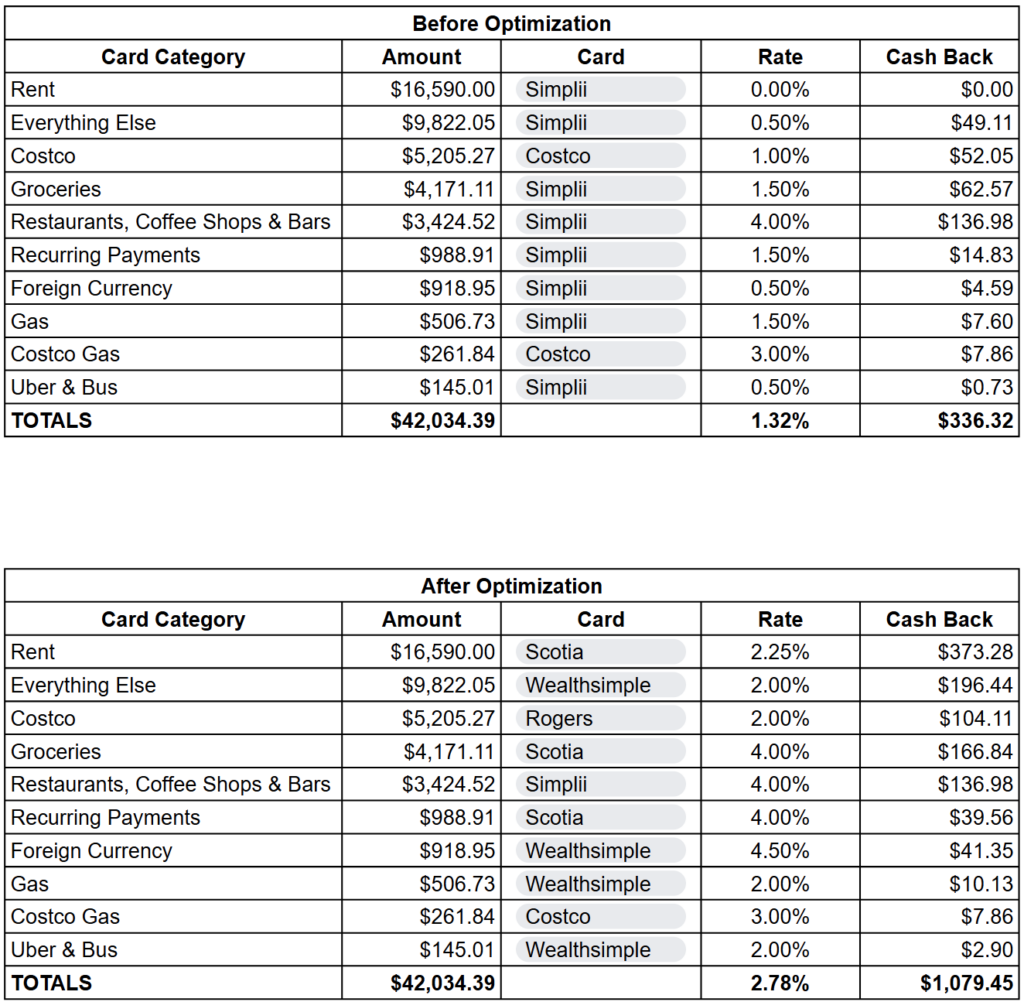

Spending Summary

Below is a summary of my credit card transactions for approximately the last twelve months. You can see that Costco, groceries, and restaurants are my main spending areas. I don’t spend that much on gas since I bike and walk often. It’s also important to note that this is a rough approximation as some of these expenses are shared between my wife and I. Other expenses such as hydro are paid with my wife’s credit card. A big chunk of Costco spending is on food which should count toward groceries.

*** Many of the links in this article are affiliate links that reward us both. It’s a terrific way to support the blog.

Paying Rent with a Credit Card

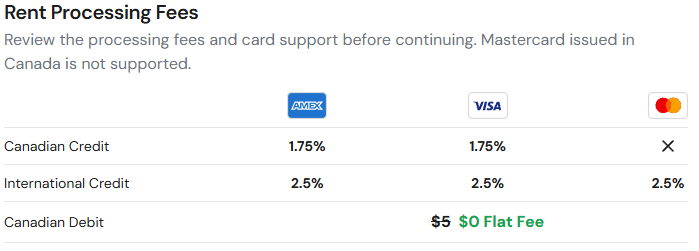

The biggest change to my credit card game will be to start paying rent with a credit card through a new company called Chexy. The way it works is that Chexy charges your credit card on file on the 29th of the month for a fee of 1.75% and then proceeds to E-transfer your landlord.

Of course, Chexy is more than useless if your credit card cash back for recurring transactions is less than 1.75%. It’s for this reason that I ordered the credit card below.

Using my Chexy link waives the 1.75% fee of your first month’s transaction.

Credit Cards

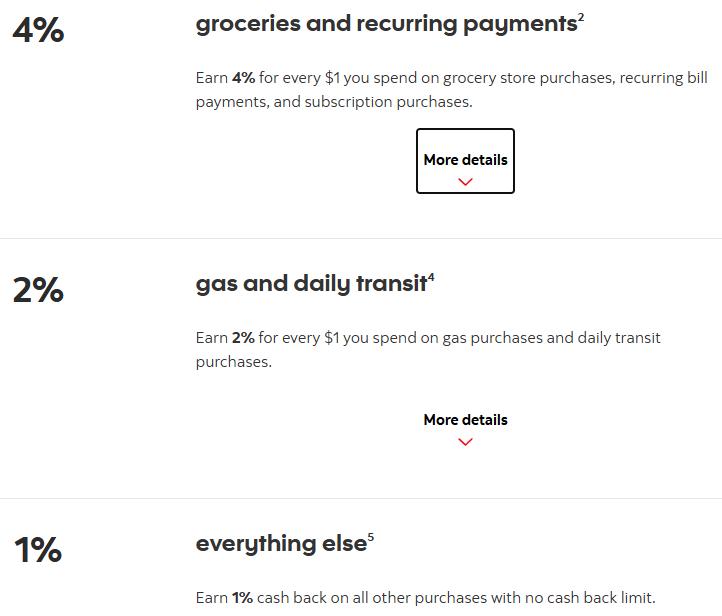

Scotia Momentum® Visa Infinite Card

The fine print of this card says that the 4% cash back only applies to the first $25,000 you spend annually on groceries and recurring payments. My monthly rent is 1,382.50$ which amounts to 16,590$ per year. I spend less than 8,410$ on groceries and other recurring payments such as Netflix and my phone bill. Thus, the 25,000$ limit is currently not an issue. This is likely to be true for a while since my wife already has the card.

I’m not a huge fan of cards with an annual fee, but the 120$ fee is a no-brainer if I get 2.25% cash back on my rent. Just on rent alone, the cash back is 373.28$ which is more than 3X the annual fee. The 4% cash back on groceries and other recurring payments will make it my go-to credit card for those areas. The annual fee for the first year is waived.

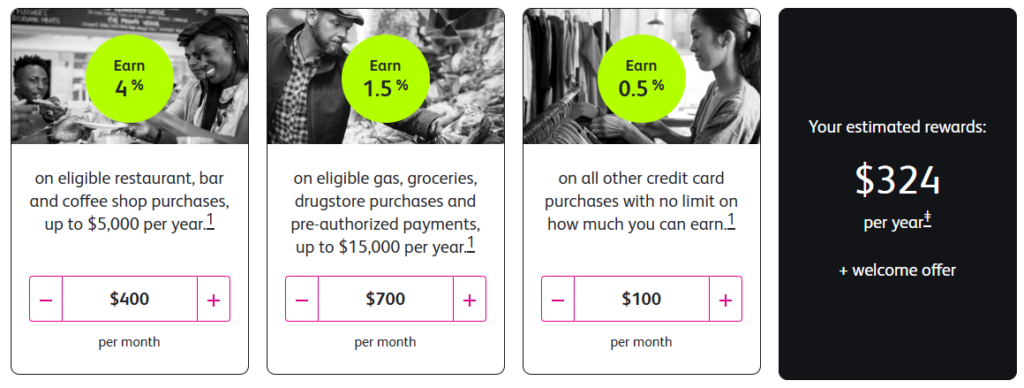

Simplii Financial™ Cash Back Visa Card

This free Simplii credit card offers 4% cash back on restaurants, coffee shops and bars. I already had this card, but I’ll now only use it for those categories. I’ll summarize the use case of each card in the table at the end of the article.

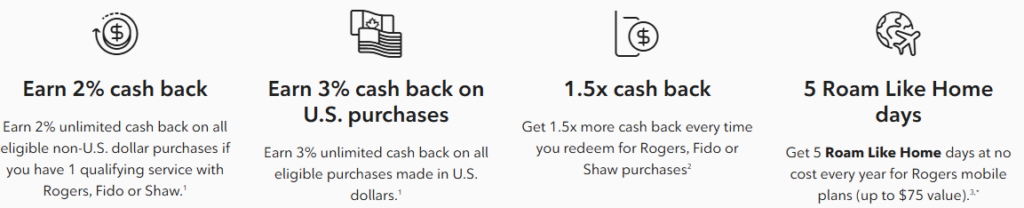

Rogers Red World Elite® Mastercard®

The free Rogers Red World Elite® Mastercard® offers 2% cash back on all purchases if the cardholder has 1 qualifying service with Rogers, Fido, or Shaw. My wife is with Fido for her phone plan so she can add me as an additional cardholder. This is arguably the best free credit card in Canada at the moment. The fact that it’s a Mastercard allows me to get 2% at Costco.

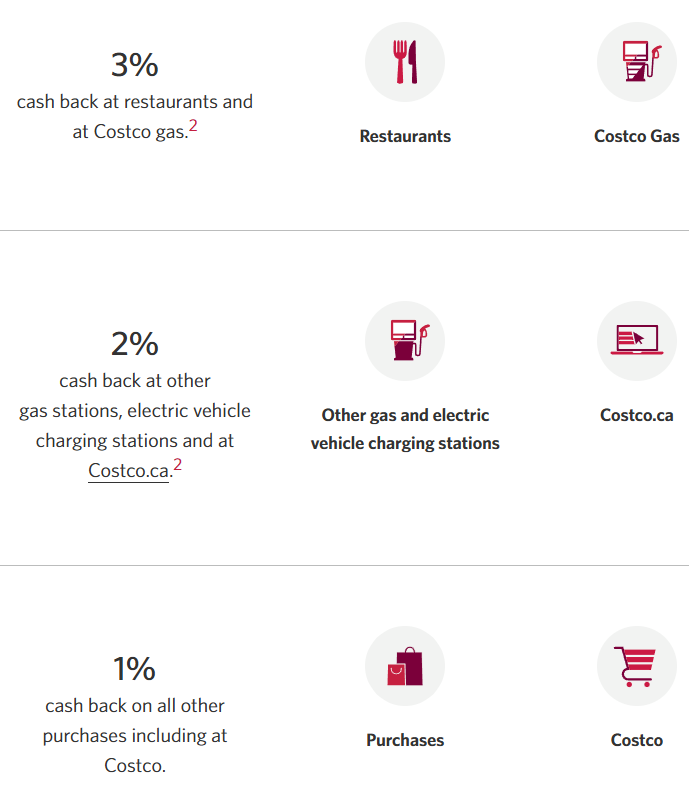

CIBC Costco Mastercard®

I’ll now start using this card strictly for Costco Gas since we get 2% back for in-store Costco shopping with the Rogers card.

Wealthsimple Visa Infinite credit card

The Wealthsimple Visa Infinite credit card will most likely be my go-to card for foreign transactions once it’s public. It also offers 2% cash back on all purchases but the Rogers card will be clutch for Costco.

Cards I’ll Stop Using

CIBC Dividend® Visa* Card

CIBC was my first bank. I’ve used their free dividend card for over a decade. This card will be of no use to me moving forward. I’ll keep it because it’s good for my credit score.

Neo Mastercard

I also signed up for the NEO credit card because it promised 5% cash back. It wasn’t the case for me and I didn’t like checking whether a store partnered with Neo. This company has potential, but its credit cards do not compete with the other cards at the moment.

Contender Cards

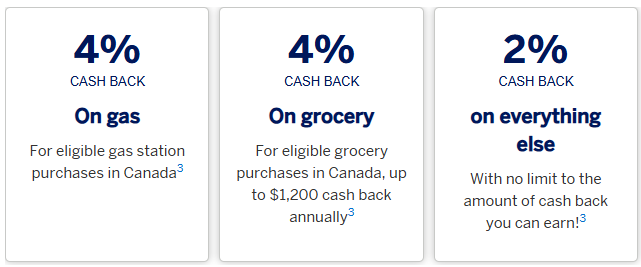

SimplyCash® Preferred Card from American Express

American Express provides attractive options. This card has great perks and offers 4% on gas and 2% on everything else for an annual fee of 120$. It’s not yet worth it given our current spending habits and the fact that we already have 4% cash back on groceries with the Scotiabank card and 2% cash back with the Rogers card.

American Express Cobalt® Card

A travel points card such as the Cobalt typically offers more value than cash back cards. That said, value is not always worth optimizing for. For example, consider paying 1,200$ for an economy flight versus paying an extra 100$ in points to upgrade to business class. You’re getting a ton of value, but you still ended up spending more money on something you wouldn’t have spent in the first place. It’s a bit like shopping at Costco. Paying 6.99$ for 12 muffins is incredible value. But why do you need 12 muffins? Similarly, travel points can offer luxuries such as airport lounges and free food but do those meaningfully improve your life? Furthermore, I don’t enjoy browsing for flight deals online. I don’t want to take a longer flight just to get better value with my points. The odd trip we’ll take every few years doesn’t justify a travel card. It’s a different story if I’d have to fly and sleep in hotels regularly.

Summary Table

It’s more useful to categorize the expenses by credit card categories to see how much cash back I’d get with my new credit card system. Note that I counted Amazon and LCBO expenses in the grocery category because you can buy gift cards in grocery stores and you can now buy alcohol in grocery stores. For example, the gift card hack can be used for one-time large expenses at Home Depot and Best Buy.

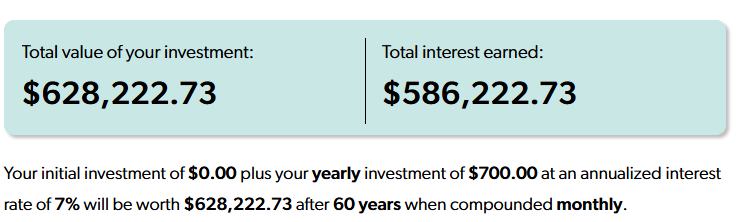

As you can see in the tables above, I can now earn three times more cash back without changing my spending habits. This is significant moula banks. It’s roughly 700$ more than my previous system. Furthermore, this doesn’t consider extra cash back with PC points or Metro points. I also get a 10% student discount at many grocery stores when I shop on certain days of the week. There’s no tax on fresh produce which saves us 13% and incentivizes us to eat whole foods.

Lastly, let’s build a table summarizing which card to use for each category.

| Area | Credit Card | Rate |

| Recurring payments Rent | SCOTIABANK Momentum Visa Infinite | 4% |

| Groceries | SCOTIABANK Momentum Visa Infinite | 4% |

| Restaurants Bars Coffee shops | SIMPLII Financial Cash Back Visa | 4% |

| Costco Gas | CIBC Costco Mastercard | 3% |

| Everything Else | Rogers Red World Elite® Mastercard® | 2% (3% if redeemed with Rogers, Fido or Shaw) |

Resources

- Simplii referral link

- Wealthsimple referral link

- Chexy referral link

- Neo referral link

- I Ranked Every Credit Card in Canada

Read This Next

- Automate Your Finances

- Our Plan to Purchase a Home

- What is your Rich Life?

- I Sold My Bitcoin

- Hindsight Thoughts on Getting Married

- The Happiness Hypothesis – Book Notes

- My Second Brain – The Secret to Productivity

- Die with Zero – Book Notes

- Die With Zero – Implementation

- The 300 000$ Meeting

- Life Score: A Subjectively Objective Way to Evaluate your Life

- Get To Good Enough & Move On

- Build Wealth And Get On With Your Life

- The Wealthy Barber – Book Notes

- What is your Investment Goal?

- Millionaire Teacher – Book Notes