Below is my implementation of Bill Perkins’ Die With Zero (see my book summary). I encourage you to go through the following steps:

- Determine your life expectancy.

- Go through the Time Bucket exercise.

- Estimate your peak net worth as a number and a date.

- Determine how much you should spend on experiences throughout your life using the Spend Curve App.

- Take action

- Set up a will and schedule your inheritance.

- Book trips.

- Set up recurring activities with people you love. You might have to pay for them.

- Take mini-retirements.

- Donate now.

- Automate your finances. Pay yourself first.

Life Expectancy

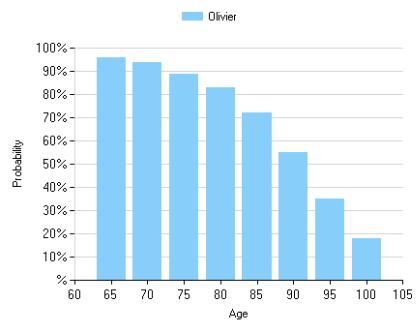

The typical life expectancy calculator will provide you with a specific number only. Unfortunately, these calculators don’t hold a crystal ball. It’s possible that you die tomorrow. The prediction is based on averages given a short list of standard facts about your health. Given these limitations, it makes more sense to think of your life expectancy as a probability distribution like the one below.

According to this calculator, I have roughly an 80% chance of living to 80 and a 20% chance of living to 100. That said, it seems reasonable to organize my life in a way that I’ll be able to experience most of the things I wanted before 80. I think it’d be wise, however, to plan financially to live up to 100.

It’s important to take into account the difference between healthspan and lifespan when optimizing over a lifetime. That said, it makes sense to plan in a way that I get to experience all the things that require a certain amount of physical prowess before the age of 70.

Time Buckets

Draw a timeline of your life from now to the grave, then divide it into intervals of five or ten years. Each of those intervals—say, from age 30 to 40, or from 70 to 75—is a time bucket, which is just a random grouping of years. Then think about what key experiences—activities or events—you definitely want to have during your lifetime. We all have dreams in life, but I have found that it’s extremely helpful to actually write them all down in a list.

BILL PERKINS – DIE WITH ZERO

I used Notion to enumerate my Time Buckets. Feel free to duplicate my template.

Four things became evident as a result of this exercise.

- Some activities, such as playing poker in a casino, fit perfectly in nearly all time buckets. It doesn’t require much time or health. It does require some amount of dispensable income, which would make it a better fit for the 40s through 60s. Other activities, such as hiking the Appalachian trail, only fit within a few buckets. Either when I’m young without kids or when the kids are independent if I’m healthy enough. Either way, I’d need to take a mini-retirement (see below) considering it’d require 5 to 7 months to complete the hike.

- The amount of activities per bucket decreases with age, given that our health is expected to decrease.

- The average cost per activity drops sharply in old age. This implies that our nest egg of retirement savings may not need to big as we think. I think my lifestyle as an old man will be relatively cheap.

- The autopilot of life pulls us away from our time buckets. We need to block off chunks of our calendars and make it a priority. See the last section to see how I plan to implement this.

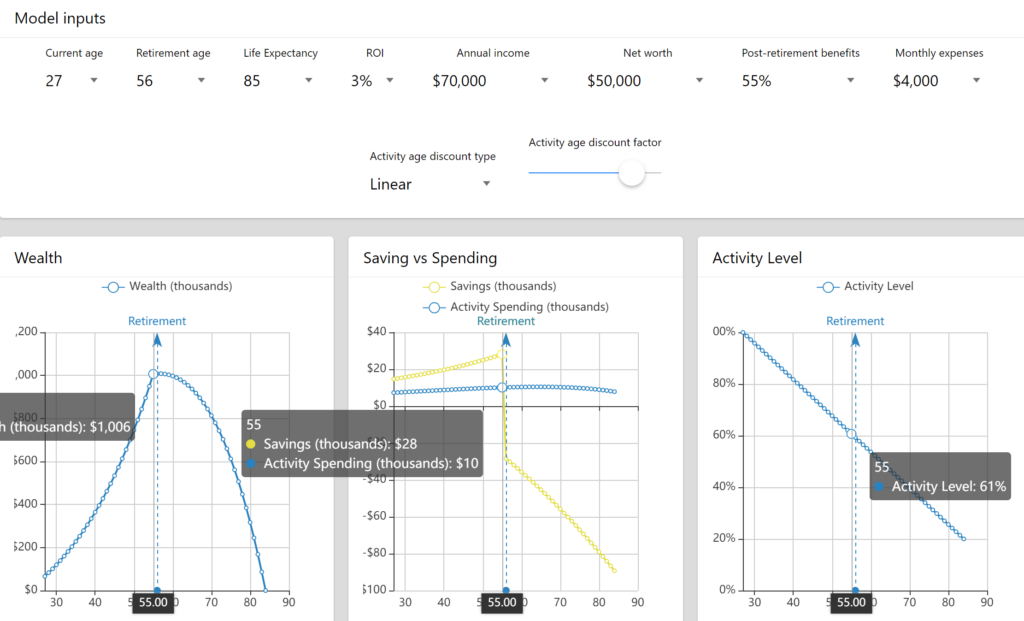

Peak

According to the Spend Curve App, my net worth is expected to peak at 55 years old with roughly 1 million dollars. This makes sense given my teacher pension, inheritances, home equity, and other savings. It’s important to consider that I’ll have to aggressively spend my savings in retirement, given that my pension should cover my basic expenses.

Spending/Saving Ratio

What should we do with the money left over after paying for our basic expenses? Should we stash it away for later spending, or should we spend it right now? The optimal balance between the two will vary between individuals. Generally speaking, we want to spend some money when we’re young, given that we don’t know what the future holds and that our health is at its peak. It’s rational to discount the future exponentially.

According to the Spend Curve App and my current parameters, I should save 15K and spend 7K this year. I was surprised to see that it was rational to spend between 7K and 10K yearly on leisure to optimize for a good life. Spending that amount of money is still slightly uncomfortable. It’s only by planning that I’ll be able to ensure that I get it done. I always assumed that I should save aggressively to guarantee that I don’t run out of money in retirement at the expense of my younger and poorer self.

I also built this Desmos calculator with different assumptions if you want to play around with it.

Action Plan

Schedule your inheritance

A big takeaway from the book is that money has decreasing utility as you age. It doesn’t make sense to get my inheritance when I’m in my sixties. I’d much rather have a smaller amount in my twenties and thirties. Here’s how I plan to dish out money to my children, depending on how much disposable wealth I have by the time they’re grown-ups.

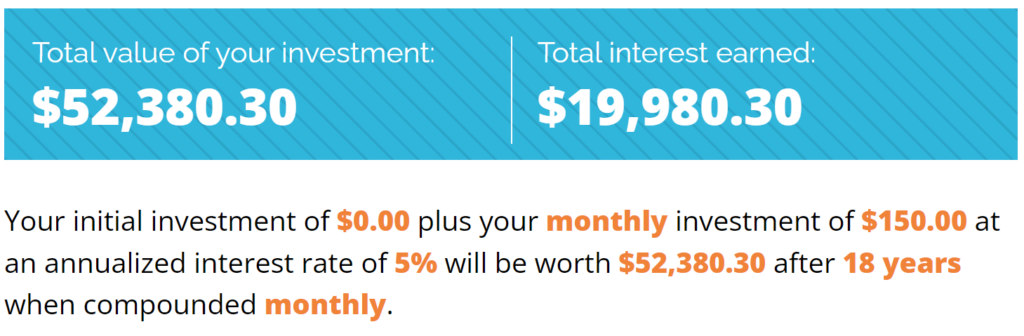

The goal is to have roughly 50k for each child. I can use an RESP and combine it with government matching. Based on this calculator, saving roughly 150$ dollar per child per month from the time they’re born should be sufficient to pay for an undergraduate degree. This is especially true if they qualify for grants and scholarships.

I plan to tell them that roughly 50k will be distributed to them as needed throughout their twenties and thirties. The less they use for school, the more they’ll have for starting their life. I can distribute this amount as birthday gifts, Christmas gifts, wedding gifts, graduation gifts, etc.

Book trips.

I have July and August off as a high school teacher. This allows me to travel on a yearly basis. We plan to go camping as a family quite often. Saving roughly 3K per year on travelling should be enough to save up for bigger trips every couple of years. Having a travel fund is the best way to ensure guilt-free travelling.

Mini-retirements

Tim Ferris talks about mini-retirements in The 4-hour Work Week. It aligns quite well with the Die With Zero philosophy. Why delay gratification until we’re not able to enjoy travelling to start travelling? Interweaving extended periods of a few months during your career is a great way to find balance and come back energized.

As a teacher, we have three built-in options for mini-retirements in addition to having summers off:

- Deferred Leave: “For example, if the employee opts for a 4/5 method, they would save and defer twenty percent (20%) of their salary each year for four (4) years, take a leave of absence in the fifth year, and be paid the amount saved (80% of salary) over a twelve (12) month period. See the Deferred Leave Guide for a complete list of X/Y options.” I can do this as often as I want.

- Sabbatical Leave: I can leave for a year at a certain percentage of my salary and the district will keep my job. I can only take this option once in my career, I think.

- Educational Leave: My school would need to approve that I go back to school with the intention of coming back to teaching. Might be interesting to do a PhD.

80/20 Calendar Analysis

Tim Ferris recommends reviewing our calendars instead of doing a new year’s resolution. Here are the things that stood out to me.

More of:

- Yoga

- Friday nights at Pure Yoga donations based. I can combine it as a social activity.

- Sports leagues

- Hockey in the winter, tennis, squash, Frisbee, and Spikeball in the summer. Badminton Wednesday mornings.

- Poker & Board Games

- Schedule every two weeks. Create a group chat. Cash-out anytime (not tournament style).

- Massages & Acupuncture

- I have benefits for it. Might as well take advantage of it.

- Elgin Massage Therapy Clinic Acupuncture & Spa

Less of:

- Grading

- Make it fun. Go to coffee shops. Grading party. Automate grading as much as possible.

- Specific people, summer jobs, complicated tutoring clients, commuting

- Embrace Hell Yeah or No!

Donation Plan

For now, contributing to various fundraisers is good enough for me. Eventually, I would like to automate a percentage of my income to effective charities. Again, giving a little now is often better than more later.

Automating Finances

A major step in the Die With Zero process is to establish a reliable financial system. The best way to get there is to automate it as much as possible. You can read this article for more details on my system works, but here are the basic steps.

- Create a savings account for each financial goal.

- Calculate your contribution amount based on often you want to make the payments and how far in the future you need the money.

- Determine the location of your account.

- Savings account: low interest, best for short-term goals (1 to 6 months)

- High-interest savings account: best for medium-term goals (6 months to 3 years)

- GICs: best for medium-term goals (6 months to 3 years) where you know you won’t need the money

- Investments: best for long-term goals (3 years or more)

- Make sure that all income streams flow into your no-fee checking account.

- Automate a contribution from your checking account to your goal account. DONE.

There’s no better feeling than having a guilt-free experience, knowing that it’s paid for. It also helps you sleep at night knowing that your money is working for you without having to lift a finger. It frees you from having to make tough decisions all the time.

Read This Next

- Die with Zero – Book Notes

- Outlive – Book Summary & Notes

- Life Score: A Subjectively Objective Way to Evaluate your Life

- Automate Your Finances

- Four Thousand Weeks – Book Notes

- My 10-day Vipassana Silent Retreat Experience

- What is your Rich Life?

- Build Wealth And Get On With Your Life

- Life is a Jar

- Atomic Habits – Book Notes

- What is your Investment Goal?

- What I Learned from Tracking my Mood for 1000 Days